The insurance industry has been around for centuries, and its role in society has remained relatively unchanged. However, with the introduction of artificial intelligence (AI) in the insurance sector, the industry has seen a dramatic shift in how it operates. AI is quickly becoming a key component of insurance services, allowing companies to better understand customer needs and provide more personalized services.

AI in insurance services refers to the use of machine learning technology to improve the customer experience. This technology can be used to automate tedious and repetitive tasks, such as processing claims and managing customer data. AI can also be used to analyze customer data and generate insights that can be used to develop new products and services. If you want to know more about AI-powered automation you may visit https://cerebrumx.ai/industry/auto-insurance/.

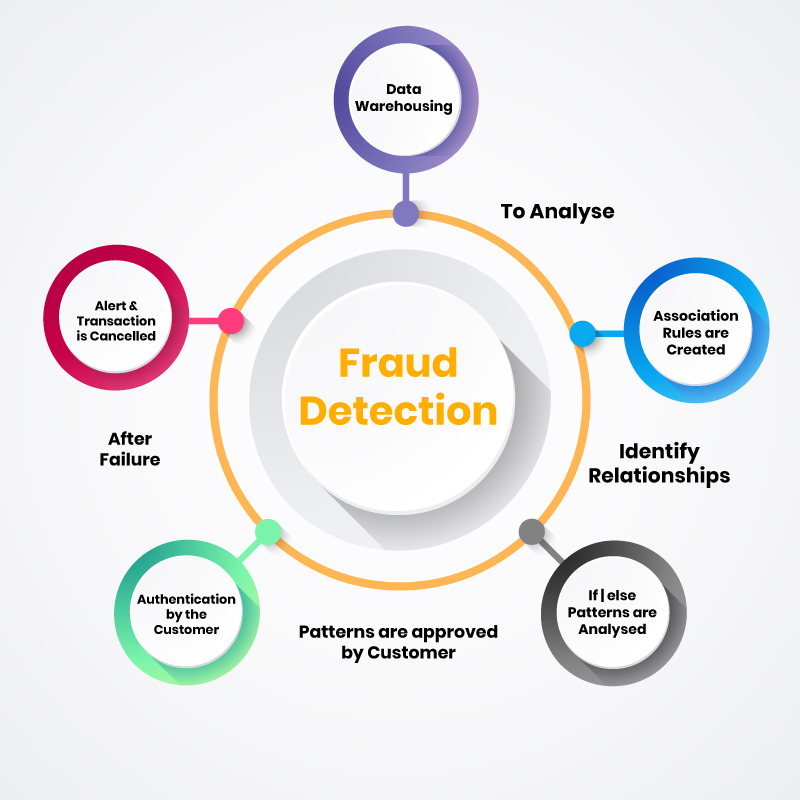

Image Source: Google

Benefits of AI in Insurance Services

1. Improved Customer Experience: AI can be used to provide personalized services that are tailored to an individual’s needs. This can help improve customer satisfaction and retention rates, as customers will be more likely to stay with an insurer that is providing them with a better experience.

2. Increased Efficiency: AI can help automate repetitive and tedious tasks, which can lead to increased efficiency and cost savings. By automating these tasks, insurers can focus more on developing new products and services, as well as improving customer service.

3. Enhanced Risk Management: AI can be used to identify potential risks and provide insights that can help insurers better manage their risk. This can lead to a more profitable and sustainable business model for insurers.